Best 5 Stocks/ETFs Boosters

What is our Best 5 Stocks/ETFs Booster?

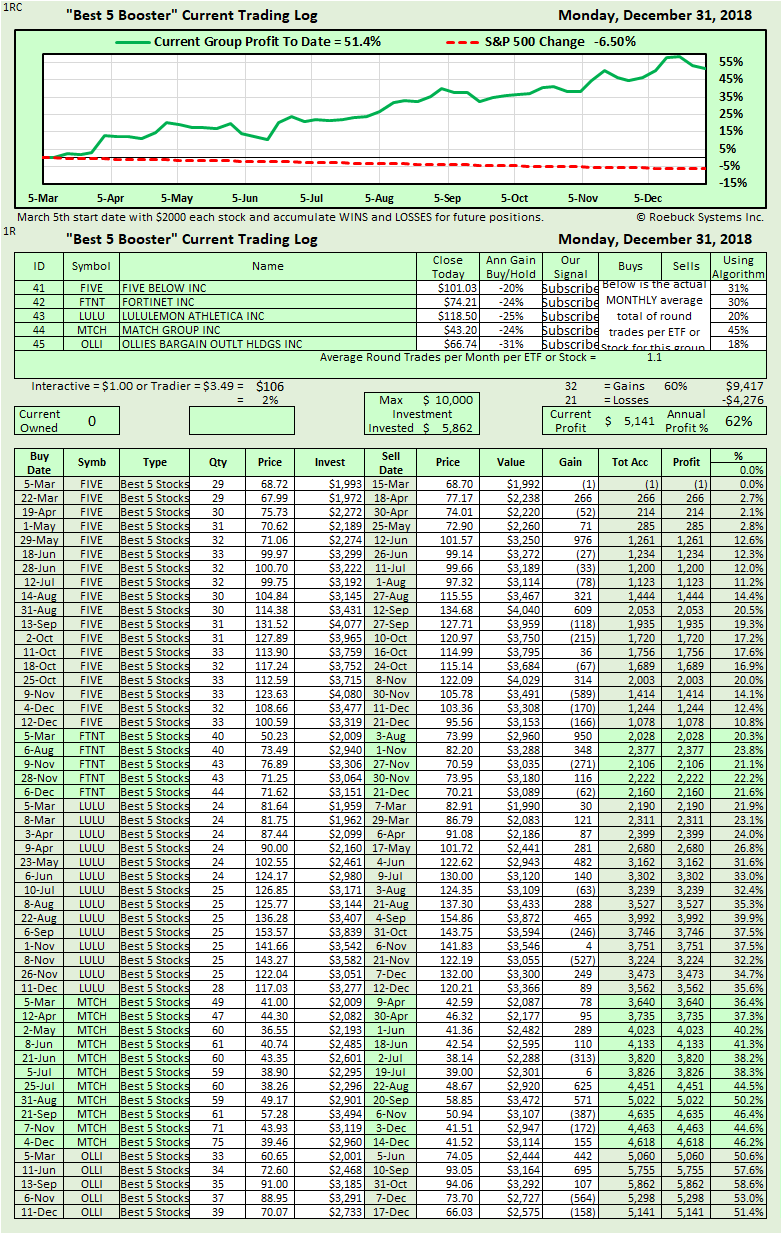

We run all our algorithms after 3:00 PM Central Chicago time every day and select the most profitable of them each calendar month to include in this Best 5 group. It may include stocks and ETFs and some of them may change each month. If a change occurs, we recommend selling and adding their replacements.

How do you use our boosters?

Each day, subscribers are sent BUY or SELL signals for these specific assets. You should BUY and SELL after the first day a new signal is given. Signals may be followed at any time but are best used after their first day. Keep these stocks in your account for as long as they have a BUY signal and remove them after the first day you receive a SELL signal.

How performance is enhanced with our algorithms.

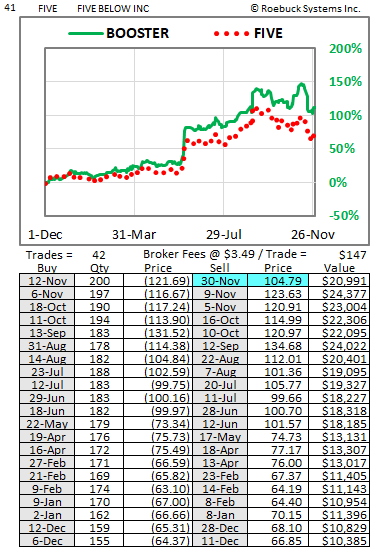

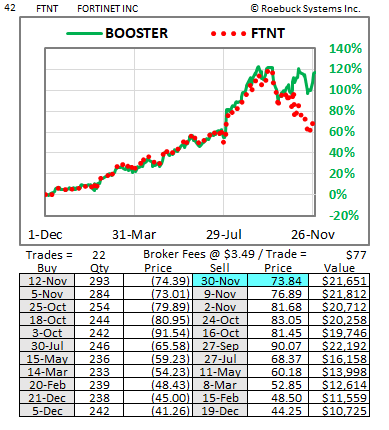

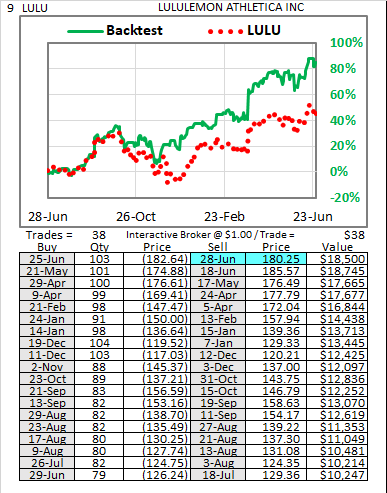

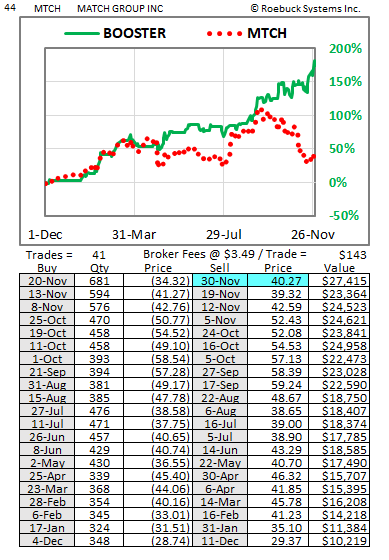

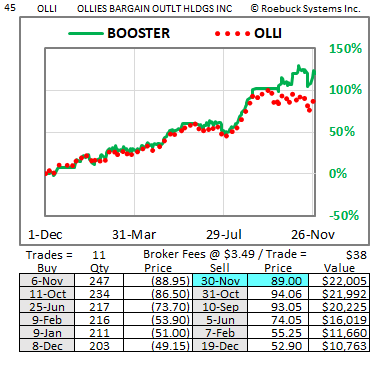

Each stock or ETF has a 1-year back-tested graph and chart within the group. Each graph shows the actual individual performance for the past year in red ink and the results of our algorithms superimposed in green ink.

Please review these graphs to see how our algorithms are quick to get you out of reversals but improve bullish performance.

Individual Stock Results:

The following charts provide details of each individual asset enhanced through our algorithms and are updated at the end of each month.

1 Year Back-tests and Trading Log showing the potential for each.

What is our Best 5 Stocks/ETFs Booster?

We run all our algorithms after 3:00 PM Central Chicago time every day and select the most profitable of them each calendar month to include in this Best 5 group. It may include stocks and ETFs and some of them may change each month. If a change occurs, we recommend selling and adding their replacements.

How do you use our boosters?

Each day, subscribers are sent BUY or SELL signals for these specific assets. You should BUY and SELL after the first day a new signal is given. Signals may be followed at any time but are best used after their first day. Keep these stocks in your account for as long as they have a BUY signal and remove them after the first day you receive a SELL signal.

How performance is enhanced with our algorithms.

Each stock or ETF has a 1-year back-tested graph and chart within the group. Each graph shows the actual individual performance for the past year in red ink and the results of our algorithms superimposed in green ink.

Please review these graphs to see how our algorithms are quick to get you out of reversals but improve bullish performance.

Individual Stock Results:

The following charts provide details of each individual asset enhanced through our algorithms and are updated at the end of each month.

1 Year Back-tests and Trading Log showing the potential for each.