Update for Followers for early 2021.

2020 has been a development and investment year for us and 2021 will bring new concepts to our methods of service to interested followers. We will be demonstrating our methods, making it easy to "follow the fund" in a way to minimize the time needed both to follow and to place trades with entirely new concepts.

In the meantime, we strongly recommend all followers to take a serious look at Interactive Brokers where we trade. Their website is more complete than most but offers excellent fills and prices that are well below the market average.

No Buys with Recent High Profitability.

It seems we are in a wait and see mode and should have been on vacation in August.

I am showing the VIX Volatility Index from Aug 4 until Sep 4 and am convinced that it was a good month to do some research.

When markets go up and down every 2 or 3 days, short-term trading becomes more difficult to predict and we would be better off on vacation.

This is what we call the 6 o’clock news volatility and the internet will increase this rapid cycle.

We continue to test a couple of different procedures and will most likely stay with them and maybe a few more during September.

Late Fix on Data Feeds.

We are adding the charts for those wanting daily updates.

September Work in Progress – 1.

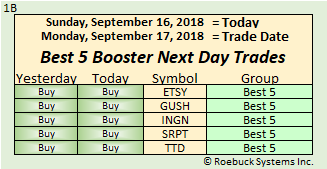

We will be testing a new series of 5 ETFs after the Labor Day holiday and will begin this group using only first day buy signals.

We will also use all first day sell signals as usual to maintain the portfolio.

Although we have thoroughly tested longer term use, we want to see how this current increased daily volatility can affect performance.

Followers will recall that we started the last group with 4 ETFs that already had an ‘own’ signal and were not first day buy ETFs.

Another rule that we are using is limiting our ‘first day buys’ to those ETFs showing a recent profit in column 6 of chart 1D. However, ‘first day sells’ will always apply.

Although we have experienced previous short periods of similar volatility, we want to take every opportunity to test different market conditions whenever they occur.

We have special interest in short-term changes because we are geared to make all trades at the next market opening price. This eliminates day-trading or having to watch markets and look for trades all day long.

At the present time, there is just 1 first day buy signal for Tuesday’s open for JDST which is bearish for Gold Miners.

A Work in Progress - 6.

Everything went against us today and especially JNUG and DRIP. Bonds made a strong effort to come back but didn’t quite get there.

First thing we do is look for sells in chart 1D which tells us to keep all 4 positions tomorrow. Unusually there are no first day buys that have shown a profit in the last 8 days. The only one is UDOW which has produced a 3.8% loss, so we will not buy anything at tomorrow’s open.

We have nothing to do but repeat tomorrow with the same 4 positions and rely on a different outcome.

We are seeing a continuation of the day by day volatility that started on August 1 which we do not like.

As previously stated, this is not helpful to our day by day signal production as markets appear to be following the current unusual daily news cycles.

A Work in Progress - 5.

First thing we do is review the signal chart 1D to see how many of our portfolio positions we need to sell.

In this case, we have our full house of 5 ETFs and TZA has a first day sell signal for the open tomorrow morning.

We bought it at this morning’s open for $53.14 per share and normally there will be no difference between any of us, but very small differences can show up.

We assume a value of the last price traded until we get a definite opening price for the sale tomorrow morning but here, we may see significant differences.

We currently have recorded the last price at $53.11 for a loss of 3 cents per share. The reason for that is extended hours trading which continues until 7:00 pm central time but the differences will disappear when we sell at tomorrow’s open.

The loss or profit will change significantly at the open because these 3x leveraged ETFs often change more between the close and the next open than they change from day to day.

Referring back to Chart 1D, there are no first day buys for tomorrow so we will stay with our 4 remaining positions for the day.

A Work in Progress - 4.

Moving on to Tuesday, we had a reversal today from a positive start to a negative close.

In fact, we almost ended with an ‘outside day’ where we beat yesterday’s high and almost beat yesterday’s low.

Bonds made a little money for us today but otherwise we survived the volatility and ended up a little.

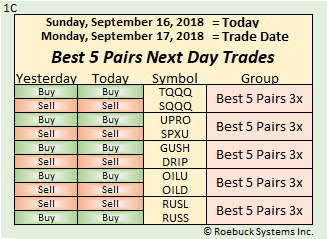

Looking at Chart 1D, we have no sells for tomorrow, but we do have 2 first day buys. We will return into DRIP for bearish oil prices and buy TZA for bearish small cap stocks.

This may be a good example of trading both directions during these high volatility periods. We will have 5 positions by retaining JNUG and TMF which are both bullish. We will also retain YANG and buy DRIP and TZA, giving us 3 bearish positions.

However, looking a little deeper, our bullish ETFs are for Gold and Bonds which generally run opposite to a strong market and could easily be tagged as bearish.

Combining them with China, reduced oil prices and small cap stocks suggests that our algorithms are expecting some pain in the Dow. “We’ll see what happens” as someone in Washington keeps saying.

A Work in Progress - 3.

Following up from Friday when we only had 2 days of history, there are no sell signals in chart 1D for our three positions DGAZ, TMF and YANG.

Today was not a profitable one as we ended up with $335.53 in profit which is down from $511.08 on Friday.

There is only one first day buy signal and that is to buy back JNUG at the open tomorrow after we sold it this morning.

We do tend to get a few more surprises when we only have 5 days of history and 2 of those days were non-trading days over a weekend.

With USA having a trade war with China, an important G7 meeting in France and the Amazon jungle on fire, the 6 o’clock news is not the most helpful source of suitable news and can only bring short-term volatility.

Tomorrow we will be bullish on Bonds and Gold Miners and bearish on Natural Gas and China.

As we have often said before, our algorithms are concentrated on what may happen tomorrow based on information today and they will make completely new assessments for the next day after New York markets close tomorrow afternoon.

A Work in Progress - 2.

After showing the almost completed Daily Best chart yesterday, we are showing the results of Friday’s catastrophic drop in the markets.

We would normally have more history to decide what to buy on Monday at the opening. As we only started on Friday, with this group, we will have to wait until Monday evening to replace the 2 sells indicated for Monday morning.

In fact, there may be more sells to replace by Monday evening, but we will continue with this live example and see where it goes. See the sells on chart 1D.

We are also showing our trading chart as it appeared on Friday evening after listing DRIP and JNUG for sale on Monday morning. We use the last price until we know what price they sell for on Monday morning.

There are 22 buys from Friday’s market turmoil for Monday and their performance will guide us what to do for Tuesday. They are not all 1st day buys but they will steadily build our master list of 52 ETFs from the 26 inverse pairs that we currently follow.

As every ETF and every trade builds its individual performance, they each guide us what to buy in the future. We have historically started new groups quite often, but August 1 was our worst start date, but it fortunately coincided with a much different selection basis with improved potential.

We will continue to demonstrate the process in detail on the Blog before making it generally available to subscribers.

A Work in Progress.

Today we tried out our new Daily Best chart and assumed we started a new group this morning with the same ETFs that we owned yesterday.

It worked out and we are adding the chart for your interest.

First Day Buy and Sell Signals are Key.

Some of this very recent short-term volatility has thrown us behind a little but we confirm the importance of the signals on the first day they appear.

These first day signals have always had a significant benefit going back to the early days and the affect is to slow down the entry into a portfolio of ETFs.

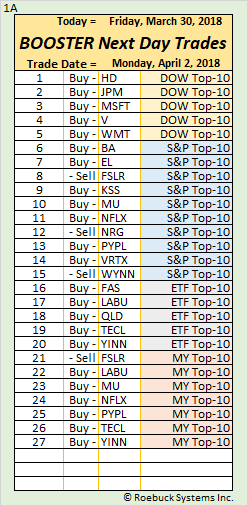

We are attaching an example of how a portfolio of 10 ETFs can be constructed but the same principal can be applied to any quantity of ETFs.

We recommend 5 ETFs as the minimum and up to 10 ETFs as alternatives.

Note this is an example not to be followed and represents 41 days of performance and the percentages will generally flatten out as the number of days of history increases.

You will also notice that the last couple of weeks of up and down daily volatility has tended to repeat unusual cycles of lower signals and push them further down the profit column.

Another statistic of interest is the average holding period dropped by 2 days down to 6, confirming further evidence of the indecision in this volatile market.

We are not currently publishing daily charts of this process until we have completed the process.

Wrong Timing for Changes.

It became clear today that starting with our new groups on August 1 has been the single worst decision in over three years.

Our algorithms have hardly changed in the same three-year period but the start dates for new groups of ETFs have been randomly based on new group design and application to leveraged ETFs.

We finally hit a wall on August 1 and the reason was 3 days of down markets, followed by this volatile display of up to 800 Dow points in opposing patterns of extraordinary news items.

The result is we need a restart for our newest and potentially highest performing groups.

We would rather delay the start, even though we had been using these improvements during previous months because one of our primary goals is to avoid day-trading that needs live management.

All our work to date has been toward trading at the next day’s opening price to avoid day-long market watching.

This last couple of weeks has seen extreme spreads from the market close to the following opening which are not conducive to starting a new set of groups by us.

We will continue updating the website and Blog as before but anticipate making the changes to the Best 5 and Best 10 groups.

Changing the Numbers.

A few times recently, I have referred to the minimum number of leveraged ETFs that should be owned or followed from our groups.

I decided to change the numbers.

Five (5) has been our minimum number of ETFs to own or follow for about 3 years now and 5 is my minimum. However, I would not argue with anyone who likes seven (7) as their minimum.

Ten (10) has been the next quantity that we have in our groups, but I indicated a preference for eleven (11), and I don’t have a good explanation for it.

Somewhere in the past, I came to believe that a maximum of 11 items or projects represented the most efficient use of one individual to follow.

In the past, I was involved with the tooling for foreign dealerships of the Ford Motor Company and I know that Ford had statistics on subjects such as ‘how much overtime was most efficient’ and ‘how many weeks’ before it became inefficient’.

This sounds very much like Corporate thinking but perhaps it was useful, and I think it may be where my eleven (11) came from. Nevertheless, I have rounded it down to 10 because it rhymes with 5, but I have eliminated 15 because it is too many.

We are still limited to 26 of the 100% inversely correlated ETF pairs because there aren’t any more of them for us to use. With the growing interest and volumes of ETFs, I expect more than 26 in the future.

Charts Updated – No Blog Tonight.

See a sample chart.

Best 5 Buys UP 22% Since July 11.

We have experienced the Yo-Yo affect these past few days but the basis of our algorithms and signals showed success.

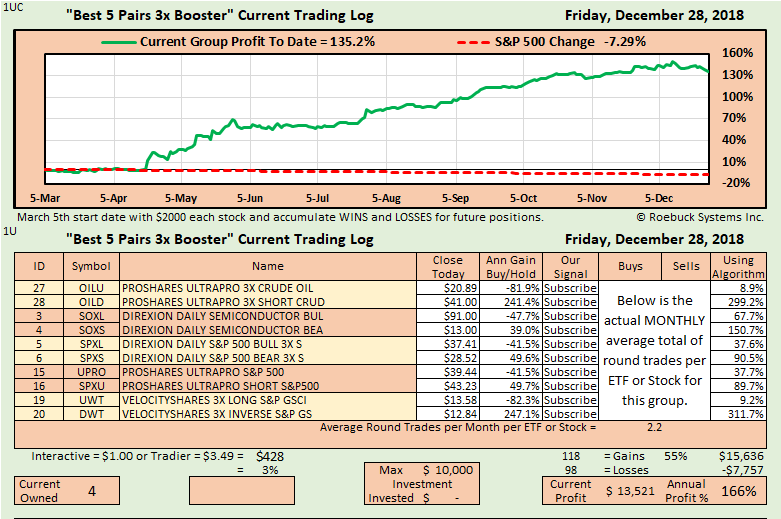

The average of all 3 groups is up 16% as seen in the daily chart above and the annual return is up 168% in 34 days.

All these trades will be published on the Historical Data page as usual at the end of the month and we expect to be offering this new program by then.

Our mathematically based rapid-entry and exit algorithms together with trading 100% inversely leveraged ETFs in both market directions has worked well.

This method worked positively in the past bullish markets but lately, we also see the benefits of eliminating direction from the investment process and over extreme volatility.

Putting Money to Work – A% or B%.

We have been collecting data for a long time and perhaps the most important data is “recent percentage of profit”.

If you are a Bond investor, next week won’t make much difference to your results but leveraged ETF investors must decide very quickly.

With ETFs, there are variables to consider such as management cost, leverage, trends and expectations.

Due to our rapid entry and exit algorithms, we find the best measure of where to invest is “What have you done for me lately”?

Along with our algorithms, we have a marketplace of 100% inverse pairs of ETFs which provide profit in both market directions. These profit opportunities are available every minute of every day, but you must have guidelines to apply the algorithms to the chosen market.

A point of note here is the delay time between the algorithm signal and the investment. Few people can watch the markets all day. For us, the time of most data input is 4:00 PM in New York when markets close and the most convenient time to apply the signals is 17.5 hours later when markets open again.

Market watchers may look for additional gains by watching futures and market statistics at the open, but it needs other levels of knowledge and is not critical.

Another decision we suggest is to spread the risk into at least 5 ETFs just like any other investment portfolio. I don’t recall where I heard this next rule but a maximum of 11 assets appeals to my thinking.

See a sample chart.

Finally, we have A% or B%. This is the simplest of rules but needs the most attention.

A% means you will invest the same amount of capital in each position to balance the risk and volatility.

B% means you will invest different amounts of capital in each investment depending on a perceived benefit and here we must return to all that data we collect.

There is no single answer to the length of trends, and we have specifically chosen these Inverse pairs of ETFs to eliminate the need to know which direction.

However, we find that the odds give an extra degree of profitability by following “recent percentage of profit” but perhaps, there is a better way!

Leveraged ETF Pairs.

Put and Call contracts rely on a series of future values called strike prices together with a series of expiration dates to produce contracts based on various underlying assets.

Call contracts generally set a series of future contracts above the underlying asset value to profit from increasing values and Put contracts generally set a series of future contracts below the underlying asset value to profit from decreasing values.

Leveraged inverse ETF pairs are more convenient for investing in direction.

Options were introduced hundreds of years ago in a London Coffee House, mostly as insurance on ship’s cargoes, due to the considerable risk of getting to a destination on time.

The first ETF (Exchange Traded Fund), started in 1993 to replicate the S&P 500 Index under the symbol SPY.

By 2006, companies were devising ETFs for many underlying assets and rapid growth followed as they were conveniently traded on stock markets and had lower management fees than Mutual Funds.

Next came leveraged ETFs using debt and derivatives to offer daily re-balanced contracts with fixed performance leverage of 2x, 3x and 4x.

These include 100% Inversely Correlated Leveraged ETF Pairs.

Each 100% inverse leveraged pair has a bullish side for upside investing and a bearish side for downside investing and an equal but opposite gain and loss occurs every day.

Our algorithms recalculate signals daily to determine which direction is likely tomorrow.

Algorithms together with these inverse pairs eliminate direction and keep us invested 365-days each year.

Numbers Tell the Story a Different Way.

As you know, we follow 26 inversely correlated pairs of ETFs. That means 26 ETFs go up and 26 ETFs go down every day by about the same percentage because each side of the pairs relates to the same underlying asset.

It can’t be exact due to all those options with higher volatility that are used to create the leverage. These play a large part in the ETF evaluation plus the wider bid/ask spreads that are present whenever options are used.

Here we show the relationship between the bullish and bearish sides of ETFs.

We added together the opening price of all 52 ETFs on July 11 for a total of $2,416.04 and then added the opening price on August 8 for the same ETFs with a total of $2.474.27. For comparison the difference is a positive 2.4%.

Note that the high maintenance cost for this calculation is eliminated because the bullish and bearish sides both have equal cost.

The differences between the S&P 500 for the same dates was a negative 3.4% but the VIX Volatility Index was a positive difference of 48.8%.

The ETF difference can be explained by a much higher volatility index which substantially increases the prices of the options used to create the high leverage of all 52 ETFs.

But here are the numbers that are affected most by our algorithms.

The split at the halfway mark on our 1B Charts serves the following purpose. If you accumulate the ‘Best Profit’ for the top 26 ETFs, you have a total of 382% and then compare it with the bottom 26 ETFs, you get a negative 290%.

The important result for our algorithms is the ratio between the 2 halves which normally had a nominal 2.4% price difference between the bullish and bearish sides of these 26 ETF pairs.

Our algorithms produced a difference between the 2 halves of 382% - 290% = 92% which is a 32% positive difference in 29 days since July 11.

Charts Updated - No Blog Tonight.

On the road today but here is a preview of part of our new program.

See a sample chart.

An Interesting Question Today.

As we accumulate more data on these leveraged ETFs, we will be announcing more rewarding groups. This is the main reason for our short Subscriber hiatus.

The question basically asked if we could take a second buy on appropriate ETFs.

Many of our followers are now used to seeing the current performance data on various charts and we will be taking advantage of that information.

However, our concentration is on rapid entry and exit signals and we are quite prepared to sell within 1-day as indicated in yesterday’s Blog.

We are prepared to make a quick decision to get in and out of an investment, rather than slow down our signals in order to buy and hold any or all leveraged ETF positions.

We find many reasons not to hold on to these trades because of their high volatility risk and their high daily management costs.

Our signals have shown much better performance when getting in and out of leveraged ETF positions rather than staying with none-leveraged versions of the same underlying sector or index.

Our concentration on ‘speed of decision’ has overwhelmed a decision to ‘buy and hold’ longer trades. The fact that we may have bought and sold a couple of times in the same trend has proven more advantageous than holding longer trades.

This is precisely the tiger that we have tamed and current and historical charts with our pre-published trades on the Historical Data page confirm that decision.

A reminder that I love my accounts with Interactive Broker at $1.00 per trade and Tradier at $3.49 per trade. I like saving money.

Are 1-Day Trades Mistakes or Not?

You would think that buying one day and selling the next would indicate that something went wrong but maybe not.

We looked at all 3 current groups that have now run for the last 25 days and reviewed all of them for the wins or losses.

The commission at Interactive Brokers for these completed trades was $2 per round trade and has already been removed from the profit.

With a total of 23 round trades for this period we lost about $8 total for each trade. This seems to vary up and down.

Last time we looked, this same check indicated a $5.40 profit for each 1-day trade, and it seems to balance out close to zero over longer periods.

We are constantly looking for ways to improve our algorithms and historically these 1-day trades have been within about $10 either way, based on our standard $1,000 original investments.

Some weeks ago, we reported on our longest recent trade that lasted 116 days and made a profit of 94%. These are the same algorithms that stay in long-term profits but will get out of these 1-day trades.

One of our favorite comments has been the rapid entry and exit capability of the algorithms which works so well with high volatility leveraged ETFs as well as stocks.

Charts Updated - No Blog Tonight.

Investing in Exchange Traded Funds.

Regular non-leveraged ETFs are well worth considering in place of Mutual Funds because they have much lower management costs.

The ETF industry began with the symbol “SPY” in 1993 and is the largest ETF in the world. It represents and mirrors the S&P 500 stock index.

With assets close to 300 Billion and an expense ratio of about 0.09%, it has a bid/ask spread ratio close to zero and a dividend yield of about 1.8%.

The past 15 years have seen rapid ETF growth competing with Mutual Funds.

ETFs are traded on stock exchanges the same as stocks and represent all types of stock indexes, stock sectors, volatility, commodities, bonds and currencies and others.

More recent growth has come from leveraged ETFs that use Option Contracts to double, triple and even quadruple their daily relative price movement.

These are re-balanced every day before markets open by adding Put or Call Options to establish and maintain the daily published leverage. These are depicted as having 2x, 3x and 4x the leverage of the underlying assets or sectors.

Leveraged ETFs are not produced for long or medium-term investing because the daily management cost is high. However, they are extremely useful to professional managers for hedging portfolios and taking advantage of short-term trending situations.

One of the latest varieties of these funds are the inversely correlated pairs of ETFs. Much like Put and Call Option Contracts, they offer a pair of funds that move in opposite directions, based on the movement of the underlying asset. By timely switching from one side of the pair to the other side, profits (or losses) can be made in both directions.

Option contracts are also used to create these ETF pairs and their producers incur the same daily re-balancing costs as leverage is increased.

Entry and exit points with short-term trades are necessary to overcome these daily management costs and that is what Roebuck Systems algorithms are designed to do.

Markets Down - We Bounced Back.

No Blog today but a good day to see how we trade in both directions.

Rules for Following the New Chart 1B.

Let’s look at an easy way to follow the ‘Best 5 Buys’ group from start to finish but before we start, we were hoping to begin our Subscriber base again this coming first weekend in August but we may need another week or so . Thanks for your patience.

See Sample Chart.

First, we have no financial connection but currently use and recommend Interactive Brokers (Online Sophisticated) at $1.00 per trade and Tradier Brokers (Online Simple) at $3.49 per trade. (Tradier offers $200 or 60-Days of Free Trades using code “ROEBUCK200”.

We also prefer minimums of $1,000 for each ETF and a minimum of 5 ETF’s.

For the purpose of explanation, let’s assume you will maintain 5 assets each day and $1,000 for each ETF.

We will use the attached Chart 1B for this example even though these results were generated just in the last 15 days.

In this case you would buy the 5 ETF symbols in column 3 with the Best Profit in column 7 and a Buy signal in column 1. Namely, you would buy DGAZ, DRIP, SOXL, NUGT and OILD.

Next, divide your starting $1,000 per ETF by the Last Price in column 4 and round-down the Buy quantity for each ETF you will be buying.

Always place all Buy and Sell orders with your Broker at the market opening price for the next trading day. This is all you do on the first day you begin following our algorithms.

Let’s now suppose that tomorrow night, you receive a new 1B Chart.

The first thing to do is make a record of the value of your current 5 ETFs and divide that total value by 5 to give you the new investment value for each new replacement ETF if needed.

Next, sell all current ETFs that have a new Sell signal in column 1. You also need to sell any of your current ETFs that have a Buy signal in column 1 but are no longer in the new top 5 positions.

Finally, you need to buy any ETFs in the new top 5 positions from Chart 1B. The quantity of ‘buys’ should equal the quantity of ‘sells’ in order to maintain your portfolio quantity.

Unless you have excess cash available in your account, you will need to deal with the ‘Banking 2-Day Rule’, which takes 2 days before cash from sales is available for new trades.

The first solution is to convert your Cash account into a Margin account. This makes inexpensive credit available to cover the 2-Day Banking Rule and will solve most of your needs. Due to current Margin Rules, you may sometimes not have enough margin credit to cover purchases. You may then make a partial purchase of the least profitable signal or wait until cash is available to complete and re-balance the trades as indicated.

The other solution is less desirable, but you could leave excess cash in your account which will be earning zero profit.

Each day you will own a different value of each ETF due to their daily price changes and sometimes you will be tempted to Buy or Sell a few shares to make up for significant changes. I would avoid these changes until you have more experience with the process.

You will be selling on the first day of Sell signals but buying will mostly occur at some point during a trend.

Remember also that 50% of these ETFs are bullish and make money during an uptrend while the other 50% make money during downtrends. This makes it possible to trade 365 days each year, no matter the general direction of markets.

Inverse Pairs YES - but Very Different.

100% Inversely Correlated and Highly Leveraged Pairs of Exchange Traded Funds and Notes.

Quite a lengthy name for an asset with long-term losses and short-term fear and danger.

Better known as “ETF Pairs”, the benefits are more visible for the non-leveraged versions due to their management costs being less than mutual funds.

Not so for leveraged ETFs! You need speed and greed for the leveraged versions and here’s why.

Every morning when markets open for business, the Managers of 3x leveraged ETFs have finished manipulating their assets by using highly leveraged Option Contracts to provide the advertised leverage at the 9:30 am New York market opening.

As soon as trading begins for the day, that leverage changes up or down but one trading day later, more Option Contracts will be applied to re-balance the ETF back to its advertised leverage for the next day’s traders.

Unfortunately, these options all have one thing in common and that is Time-Value. Time-Value loses value every day. These options are all worth nothing at their expiration date and therefore our leveraged ETFs are losing value every day.

You need SPEED as provided by our algorithms with average 10-day trades.

You need GREED as provided by our selections of 3x leveraged ETFs.

And, you finally need DIRECTION as provided by our algorithms selecting the bullish or bearish side of these leveraged ETF Pairs.

You can now trade 365-days each year, with speed and with greed, knowing that direction is being handled by our algorithms along with the best selection of: -

“100% Inversely Correlated and Highly Leveraged Pairs of Exchange Traded Funds and Notes”.

Some Not-So-Obvious Advantages.

Please know that we follow the exact same system that we publish for Subscribers and Blog Followers.

However, there are some features and information that we have incorporated into these new algorithmic methods and charts that give certain useful info.

For example, if you look at subscriber chart 1B on the ‘How to Follow’ page, note that the top performer on Friday, July 26 was the Bearish DGAZ.

Now look at the worst performer at the bottom of the same chart to see the Bullish UGAZ. Useful information!

On July 25, just past the middle of that day’s Blog, I was explaining how we held the Bear DGAZ for 116 days for 94% current profit or an annualized gain of 288%.

That was an unusual length of time to hold a leveraged ETF (Exchange Traded Fund) but our same algorithms that have average trade lengths of less than 10 days, also held DGAZ for 116 days.

As you know from the symbols, the bullish UGAZ (Up Gas) and the bearish DGAZ (Down Gas), are a perfect 3x leveraged pair of ETFs that represent the daily fluctuation in the price of Natural Gas.

Gas is typical of single asset ETFs. Others, such as Gold, Silver and Semiconductors can also have longer single-direction trends that reflect world-wide conditions as opposed to Stock Indexes that have a range of trends within a single ETF.

While looking at Subscriber Chart 1B, you can see how easy it is to follow our algorithmic signals.

1 – Decide on ‘Your Quantity’ of ETFs to maintain every day in ‘Your Portfolio’.

2 – Daily, calculate current ‘Average Value’ of ETFs held, or decide on a new value.

3 – Daily, sell all ETFs with ‘Sell Signals’.

4 – Daily, sell ‘Buy Signals’ for ETFs no longer in your ‘Replacement Portfolio’.

5 – Daily, buy replacement ETFs from top of ‘Best Profit List’, using new average value.

Ready Soon and Ahead of Schedule.

We have 2 weeks of good anticipated results and are almost ready to go.

See Sample Chart.

I am showing the new subscriber chart which may be subject to minor changes.

The first thing to do is look at column 1 and sell everything with a sell signal at the next market opening price.

The second thing to know is how many ETFs you have decided to own every day and list the Buy Symbols starting at the top of chart 1B.

Now sell all ETFs not on your new list to own and buy everything that you don’t currently own. How simple is that?

Your only other decision is how much cash do you want to invest in your portfolio of ETFs. Our recommended minimums are 5 ETFs and $800 per ETF for a total of about $4,000. For these minimums, we suggest you use a low commission Broker such as Interactive Brokers at $1.00 per trade.

Assuming you decide on a portfolio of 6 ETFs to start, each evening you divide your new portfolio value by 6 and use this “replacement value” to replace any ETFs as necessary using the simple rules above.

Remember: -

First, sell all sell signals.

Then, sell all positions not in your new list of top-ranking replacement ETFs.

Finally, use your new “replacement value” to replace all sold ETFs by top ranking ETFs from chart 1B at the next market open.

This will maintain your portfolio every day in your quantity of positions that have the highest current performance rank.

You will notice that in column 5, you see the sector of each ETF and whether it is a Bullish or Bearish ETF. For an example, when the markets are generally going up in a strong bullish trend, 20-year Bonds are likely to be bearish and going down.

Gold and gold miners are also likely to have less value when markets are strong.

These ETFs are highly leveraged and should not normally be held for long periods due to the high cost of creating the leverage and renewing the leverage daily by using options.

Our average trade using our rapid entry and exit algorithms, have historically been less than 10 days. Quite often they will be for 1 day only. These leveraged ETFs can easily have daily movements of 10% and more.

Best 5 to 15 ETFs & the 2-Day Bank Rule.

The 2-day banking rule where you must wait 2 days for cash from a sale to hit your account is easy to handle.

The easiest way to handle it, when possible, is to open a Margin account and automatically borrow the money for the 2 days that you may have to wait.

Certain accounts such as IRA pension accounts cannot do that. In this case, wait until the funds hit and buy the next currently highest performing ETF from the signal performance chart 1B.

If your account has available funds, do all sells and buys at the next day’s open.

I usually go down my account holdings, which in most cases is in alphabetical order and take care of any ‘sell’ signals first.

Then I look at my account value or use the value that I have assigned to Roebuck Systems and divide that sum by the number of positions I intend to hold.

I can now look at the 1B signal chart and decide which are the highest performers that I need to place buy orders for tomorrow’s market opening price.

You will normally be selling when you see a “T” indicating the first day of a new sell signal, but your new buys will be selected according to the highest ranking performers on the 1B chart and you will not wait for a first day “T” signal.

From the various comments that I receive, I realize that some investors can often test ideas or have preferences for specific sectors. Our published charts and results are strictly based on our signals and the timing and assets in the groups represented on our website.

What Will We Buy Tomorrow?

What Will We Buy Tomorrow?

The answer at 7:00 PM every evening.

Rules for Best 5 Buys group.

1. If we already own it and it remains a Buy in our Best 5 Buys group, we keep it.

2. If it is no longer in our Best 5 Buys group or has a ‘Sell’ signal, we sell it.

3. If we have less than 5, we ‘Buy’ the next highest symbols with ‘Buy’ signals.

We will shortly be contacting you again as soon as we finish web construction for our new groups. Meanwhile: - . . .

. . . You will need a minimum of about $800 for each symbol, and we recommend a minimum of 5 Symbols or any quantity up to a maximum of 15.

Place all Buy and Sell orders at your convenience at the next Market Opening Price.

To save lots of money, we use and recommend Interactive Brokers (worldly online site at $1.00 per trade) and Tradier Brokerage (simple online site at $3.49 per trade).

We offer Free Blog Membership to all Followers and a 30-day Free Trial to all Subscribers.

Trading at Tomorrow’s Opening Price.

You will also notice that when you do a BUY trade at the open, the market will often be down, and you buy at a lower price but by the end of the day you are back to even or in profit.

The reverse often happens when you do a SELL trade. You close out with a higher price but would have sold lower by the end of the day.

This is a result of the rapid entry and rapid exit algorithms and their methods and another result being the average 10-day or less trade length.

The temporary chart RKE to the right has some interesting numbers at the bottom. This represents the 52 original ETFs or 26 pairs since July 11, 2019. I added the winnings at $1,810 and the losses at $752 for a total of $2,562.

In 11 days, we made 71% profit and lost 29%. This is just another very early indicator of decisions made entirely by the current algorithms.

However, we should only be buying currently winning ETFs and should be avoiding those with the losses.

They are very sensitive to potential changes in direction and send out signals with the slightest provocation.

On the other hand, they are historically more often correct than incorrect and that is how they work.

Remember they are totally designed to deliver a decision for tomorrow and not the day after. They must be completely recalculated every day for new decisions.

If you went to a casino with the secret knowledge that red was going to come up 60% of the time, you would be very happy. We are depending on real world happenings and real-world news on each asset individually and not just one decision for each day.

However, the result is similar. You can make one decision and be correct 60% of the time or you can make one thousand decisions and be correct on 60% of them. Either way will eventually give you a positive result.

Excitement or Conservatism.

I first started investing in my twenties and preferred exciting results.

I had emigrated from UK as Technical Director to Bristol de Mexico S.A. in Mexico and a fellow cricketer helped me invest in the Mexican stock market.

Three years later, I emigrated again to Union Carbide in Charleston WV where I opened my first US account at Merrill Lynch. This was a losing experience.

I was an early eSignal and other data feed customer and went to endless seminars for years, seeking the latest and greatest and exciting investments.

This was always a part-time job for me as it is for most investors but years later, after a business career in math, computers and engineering, I had more time to enjoy and think more seriously about investing.

My background includes a lot of math and with this and the enormous amount of data available to us today, we have slowly but surely developed these rapid entries and exits into a range of assets.

I mentioned the speed of these signals yesterday which also gives us a great advantage into leveraged assets. The leverage provides the additional market movement with greater profit streams.

We previously worked with volatility and with a program that improved professional portfolio management results. Using our booster algorithms with Exchange Traded Funds representing these portfolios, we could obtain 20% to 35% annual returns whereas they are producing 8% to 15% for the investing public.

By moving to high volume and leveraged ETFs, we could produce 45% to 75% annual returns, again by replicating their portfolios of stocks and bonds.

There is however, a secondary benefit to our rapid entry/exit signals. If you review the back-test charts on our various group pages, you can see our history of staying with profitable trends but avoiding opposite price moves.

This is where our change to 100% inversely correlated ETF Pairs became a key to our programs. Instead of getting out of a bullish short-term trend, we could quickly invest in the opposite direction by simply switching to the inverse side of that inverse ETF pair.

This also made possible the move to leveraged 100% inversely correlated ETF pairs. Here, our signals can make about 2x the profit from the 3x leverage that is available from these daily adjusted ETFs. With average 10-day trades, we could overcome the high daily management costs and still profit about 200% of the 300% daily adjusted movement.

That brings us almost up to date.

As often mentioned, there are about 26 leveraged ETF pairs that we can reasonably work with today. We follow all 26 pairs plus a few others and like all assets, these pairs have their own trends. They are mostly short-term trends leading to longer-term but not always.

We follow these trends and calculate which ETF pairs are currently profiting the most from our algorithms. We are in the process of making that information available to followers so that we can stay in the pairs at the top of that list.

But more than that!

We no longer are required to stay with the pairs concept. We will offer the current most profitable leveraged ETFs, regardless of pairs and regardless of bullish or bearish direction. Why not go with the highest current returns with the highest potential return on investment?

Remember that our speedy algorithms continuously work in both directions of leveraged ETFs pairs and they also work 365 days of each year, no matter the direction of the markets!

Our new groups will include the Best 5, Best 10 and Best 15 leveraged ETFs based on current recent performance. We will trade in and out every day and you can follow our groups or select your own preferred groups all year round.

We now recommend no more than 15 in a portfolio unless a ‘BUY’ signal exists, in which case, you may decide to keep these additional ETFs until the first day following a new ‘SELL’ signal.

Conservatism can still be applied with 365-day trading.

Weekends and Denominators.

Our new system results will be 25% worse on Monday due to weekends.

The sample I am showing above was only 8 days old and there is little chance of any upward movement when markets are closed for the weekend.

On the other hand, a downward move is guaranteed by 2 more days added to the 8-day denominator for a 20% hit.

I did think about using market days as the denominator in the early days but to be honest about it, I was too involved in the algorithms at that time. Besides, it wouldn’t represent the facts.

This does not take away from the enthusiasm we have for the renewed algorithms and using them in this new signaling method. The results will demonstrate these improvements.

The key to this is the speed at which we can get in and out of our positions in very volatile leveraged ETFs.

A Look into Future Algorithms.

Maybe we chose a good day to start? I have no idea why we chose July 11, 2019 to modify our program above, but I was very sure that we had a better way.

The numbers since July 11 have been developed in the same way that we always produce and distribute signals and we expect to restart our program within the next 30 days.

As previously stated, we will bring more information to the Blog when available.

Thanks for your continued interest.

By Way of an Explanation.

We are temporarily stopping signals going out tonight to followers due to our need to make some changes.

The Blog will continue and information as it becomes available will be indicated and the short wait of less than a month will be well worth it.

Nobody is being charged for this period and nobody must continue with our signals when we resume them.

Our results for the past 3 years can be found on the Historical Data page and future results will include significant improvements.

In the meantime, I strongly advise followers to take advantage of the lowest Brokerage fees available whether you continue with Roebuck Systems or not. Be prepared for the possibility of a few more trades with additional profits.

We continue to use Interactive Brokers at $1.00 per trade in the USA with a very reliable and substantial world-wide reputation.

We also use Tradier at $3.49 per trade, also reliable with an extremely easy site to trade and hold accounts. They also offer $200 or 60 days of free trades to new accounts using the code ROEBUCK200.

I must add that we have no financial arrangements with either of these Brokers, other than holding investment or test accounts with them.

After continuing to research and develop our mathematical algorithms, we do have some significant changes and improvements to make. We regret the need to pause for a short while and hope to keep you interested in our service.

I do advise that any current investments of ETFs or Stocks, based on our signals, should be sold at tomorrow’s opening price.

Thanks for continuing to follow us. I enjoy doing this and it does not feel like work to me, but changes must be made. As I have noted before, “There is always a better way”

Wait 1 Day and SEE the Difference.

Stocks were up by 1% yesterday and ETFs are back up by 10% today.

My comments yesterday included the ability of ETFs to trade in both directions and today we see the benefits of that.

To be precise with these results, we must first know whether the investment is in 5, 10 or 20 different stocks or ETFs.

No matter which group is selected, the benefits and reduced risk with inverse ETF pairs is important every day and worth knowing and considering.

Stocks Overtake ETFs Today.

80% average annual returns after brokerage fees for stocks today versus 79% for ETFs.

Not surprising to longer term followers as ETFs have had more difficult markets lately compared to stocks at new highs.

Of course, current stocks are measured over the past 29 days and current groups of ETFs have been running now for 137 days. Timing always plays a part with these comparisons.

We have had both in front at different times, but the more interesting fact is that we can average these levels at all.

Our most conservative groups of 20 stocks and ETFs have averaged 48% and our most aggressive groups of 5 stocks and ETFs have averaged 114%.

Looking back without checking exactly, I can’t remember a time when our results were not at least in this area and many times we have seen better.

Stocks will naturally suffer during down markets, but these inverse ETF pairs just keep on going no matter the market direction and their ability to quickly change sides.

A week or so ago, I was referring to the speed that we get in and out of positions and this review came about as we were measuring whether we should switch sides or perhaps switch pairs and we have some very interesting results coming out in the future.

However, today we look at all 6 groups that we currently offer with average returns around 80% and individual returns from a low of 47% and a high of 126% and pause to appreciate them.

Risk is a subject that has always been an important consideration for us, and inverse ETF pairs for the last 3 years deserve serious consideration.

Experiment Develop and Analyze.

When does your work change from experimenting to developing and finally to looking back and analyzing?

My answer to that question is 2018.

For 3 and more years we experimented with various tradable assets and repeatedly found positive results mostly over short periods of time.

One of the common factors seemed to be shorter length of trades no matter what asset was being tested. We now have historical facts showing average trades of less than 10 days and some reversals in just 1 day.

Both facts confirm that our algorithms support fast entry and exit from trades and staying with profitable trades at least for an average of 10 days.

Using the recent Exchange Traded Funds market and the more-recent inversely correlated ETF pairs, we find that our algorithms work equally well in up or down-market conditions.

Their fast entry and exit also performs well with leveraged ETFs where the excessive management costs specifically require short-term trading.

History also confirms their ability to stay with longer-term trades if required. We recently bought 11 shares of DGAZ, a 3x leveraged ETF on March 1 for $970 and held them for 119 days, finally selling on June 25 for $1,809, This was a profit of 94% at an annual rate of 288%.

To be fair, we also recently bought 10 shares of UDOW, another 3x leveraged ETF on March 1 for $990. We held them for 94 days, selling on June 3 for $840. This was a loss of 15% at an annual rate of 58%.

So, we experimented with algorithms and then developed their ability to work in multiple investment markets.

The above comments plus the Historical Data page on our website confirm these various markets and trades. We are confident our results will lead to continuing opportunities in the future and we are making some helpful and positive changes that will benefit followers.

Some Statistics Since March 1.

The following numbers are taken from pre-published trades and their results since March 1, 2019.

Bullish winning profits were $3,547 from 17 ETFs and bearish winning profits were $2,222 from 11 ETFs.

That is $209 each from the 17 bullish ETFs and $202 each from 11 bearish ETFs.

This also represented 61% of profits from bullish trades and 39% of profits from bearish trades.

All this makes some sense as the S&P 500 is up almost 8% over this period.

If we look at total dollars including losses, bullish profits were $2,750 and bearish profits were just $812.

In this case, bullish trades made 77% of the profits and bearish trades made significantly less at 23% of the profits. This indicates that losses were more likely on the bearish sides than the bullish sides.

This also seems to make sense as the markets had a bias to the upside of almost 8% during this period.

For the record, one bullish ETF and one bearish ETF did not trade at all, so the results are from 25 bulls and 25 bears instead of 26.

Why do we include these statistics?

The reason is to demonstrate that during any general market trends, we switch between the bullish and bearish sides of these inversely correlated pairs to take profits from both directions.

This is the reason we can trade for 365 days a year. If the S&P 500 had gone down 8%, we mostly likely would have made more profits from the bearish sides of the same pairs.

Lower Interest Rates Indicated.

The indicated lower interest rates should be good for markets but global slowdown not so good.

The good news is you are now trading inversely correlated ETF pairs and our algorithms put you in the best direction, up or down, throughout market trends.

The advantage of being in leveraged ETFs is the trades will average less than 10 days which works for short-term reversals as well as long-term trends.

You will find many of our best performing ETFs are in the bullish sides of the pairs but also in the bearish sides.

This is exactly the benefit of being able to trade 365 days each year, no matter which direction the markets are moving.

This soon anticipated interest rate reduction will give a short-term boost and most likely, a short-term rise to US corporations. However, the rest of the world is slowing down and this will likely move markets in the opposite direction.

We used to trade options, as one of the main ways to trade direction, but the rapid reduction in time-value makes it a higher risk and higher volatility method of investing.

We can trade a selection of 3x leveraged ETFs in both directions with low risk. This can provide the kind of profits available to option traders but without the rapidly changing time-value.

We can also trade virtually anything in both directions, from commodities to bonds, plus most of the stock indexes and sectors in between.

How Many ETF Pairs are Enough?

We have usually suggested a minimum number of ETFs to follow is 5 pairs.

One of the difficulties is the number of energy-related pairs meeting volume requirements is also 5 and this can sometimes be a problem.

Duplicating sectors such as energy, in a small group of ETF pairs can increase volatility of portfolios considerably, even though the pairs represent different underlying assets within energy.

Due to the high volatility of 3x leveraged assets, it is always beneficial to decide how much volatility is acceptable.

On the other end of the scale, we are aware of having too many ETF pairs. Followers will know that we recently reduced our published groups to just 20 of the 26 pairs that we continuously follow.

This is due to only 26 pairs can meet our requirements and the volumes necessary to be included.

Performances of these various pairs and sectors have varied considerably over the 3 or more years that we can refer to. Our conclusion is that the 6 pairs out of this total of 26 available pairs can be eliminated from consideration for 30-day periods, beginning each month when we make up the various groups.

Our current results suggest that the maximum of 20 pairs in our largest suggested groups may also be too many. We may be better off by reducing that largest group to 15 pairs.

We are considering this change to our groups which would be the 5 Best, 10 Best and 15 Best pairs each month. This would leave out 11 of the total pairs as backup selections for future months.

Recognizing Good Charts.

We like to show the back-test charts for every stock or ETF that we follow below the group charts on each page.

These were useful to us during the developing process of the algorithms.

This first chart of DGAZ shown below was the best gainer as of the market close yesterday and shows the percentage of gains and losses for the past year through June 28.

The red dotted line shows where the actual price of DGAZ declined over the year and the green line shows the gains with all trades detailed below it.

Obviously, this is one of the best charts showing how the 3x leverage worked to generate huge profits from the opening price on Nov 29 to the open on Jan 2 when we sold it.

This is a good example of how we use 100% inversely correlated ETFs. We were able to profit greatly from the decline in the price of natural gas by owning an ETF that moves in the opposite direction to the underlying asset. Starting with about $10,000 (134 @ $74,40) we ended up with $65,392 according to this back-test.

The second chart for UGAZ is the bullish side of the pair and generally moves in the same direction as the underlying asset. Starting again with about $10,000 (158 shares @ 63.13) our algorithms were able to pick away at the movement and end up with $25,327 by Jun 38.

Together this pair of back-tests produced a total of over $90,000 from a total starting capital of $20,000 or a 450% profit while the actual prices of this ETF pair lost almost 100% each in management costs.

These are back-tests and not actual trades, but the same algorithms are now used to determine future trades. Notice how these algorithms can make profits from straight line performance and avoid large downturns.

Opening Prices and 3X Leveraged ETFs.

Opening prices on most leveraged ETFs can be nerve racking to watch, especially when you are buying them, and you get to pay large premiums.

It feels like those high daily management costs are all being paid for by the buyers at the market opening price.

Fortunately, we sell as many shares as we buy in the long run so whatever and whenever they are paid, we see both sides of the coin. Unfortunately, this just means we get to pay those high fees sometime in the investing process.

We know we are working with ETFs that have this 300% leverage and historically, depending on market directions and volatility, we have long-term results showing a net benefit of about 200% in our trades or about two thirds of the leverage.

Today on ETFs we ended up with a loss of just $9.00 total, and on the new stocks, we lost $231.00 total. Both groups started with a total investment of $35,000 on our 4xxs chart.

At the end of the day, it is difficult to say that we lost less on the ETFs because of the leverage or, put the other way, we lost more on the stocks because they have no leverage. It is more likely that we lost less on the ETFs because we invest in the opposite direction, whereas with stocks, we must move into cash.

The problem here also reflects an earlier comment that ETFs mostly represent multiple assets such as the S&P 500 and the stocks are single organizations. It takes a lot more money to move 500 stocks (or options) the same distance as a single stock investment.

Double Your Money with Algorithms.

We display this statistic every day in our stock charts, but it isn’t something you see at first glance.

Look at the 5 Best Stocks page at the bottom of the column heading “12 Month Stock Gain”. Today you see the average annual gain of the 5 stocks increased by 115%.

Now look at the last column heading “12 Month Algo Gain” and you see at the bottom of the column by using our algorithms, the average stock gain was 256%. Double your money + plus a bit.

You can do the same with the 10 Best Stocks chart where today you see 98% versus 194%. Almost double.

And you can do the same with the 20 Best Stocks chart where today you see 91% versus 179%. Almost double.

This doesn’t calculate with ETF Pairs because the bullish and bearish sides move in opposite directions.

However, it was this doubling of annual returns on almost any selection of assets that first grabbed our attention. We then started to look at professional investment portfolios that could also be doubled. For example, many managed trust accounts that traditionally make 9% annual return could now make 18% using our algorithms.

At that point our research told us that many professional managers were turning to ETFs or Exchange Traded Funds. These now trade in very large volumes because they are more efficient than Mutual Funds.

From there, it didn’t take long to jump to Leveraged ETFs and finally to the newer 100% Inversely Correlated Pairs of ETFs.

It stands to reason that if you can double a whole range of tradeable assets, you may as well go fishing for assets that already have a high annual return rate.

Stock Current Ranking Chart.

We mentioned that the new Stock ranking numbers only represent the profits since June 17 for this July month.

As this period is fewer days than a normal minimum of 30 days, the attached Ranking Chart RK shows the same results in order of profits realized.

This column is useful for subscribers who like to make their own selections.

It is also possible to make selections that might include ETF pairs as well as stocks but there are some details to consider when mixing.

ETF pairs are ranked as pairs because we want to have the opposite direction available to us if the algorithms are seeing a direction change for the next day. Of course, followers will know that the change in direction does not always occur on the following day. Very often we see a pause and a resumption in the same direction.

Many times, we get the undecided signal which means we stay out of both the bullish and bearish sides of the pair with 2 Sell signals until the decision is more clearly triggered.

One interesting capability of these algorithms is to consider the ETF pairs as individual investments rather than as pairs, similar to the way we are now considering individual stocks, but we will report on that in the future.

The reasoning for that is why wait for a lower profit direction change when you may have the availability of a higher profit opportunity in a completely different sector.

Apologies for Housekeeping Yesterday.

Yesterday was a day that got away from us on some housekeeping and we apologize for that.

Bringing stocks forward to July instead of August was a worthy goal but a more complicated job than we planned.

Some charts had some misleading text and a few other glitches, but I believe we have everything under control now and the numbers and symbols were always correct.

I do want to reiterate that some values do continue changing from the closing price due to afterhours trading.

These are all self-correcting, but a few questions do arise because of this detail.

It is also true that we only had 2 weeks of actual trading on the new stocks that are offered for July instead of the normal month that we usually like to have. This affects the relative profits between the 20 selections and will cause the ranking of profits to vary more than usual for the best 5 and best 10 groups at month end.

Some followers may prefer to wait for August so that more current history is included in the group selections.

This is also the first month that we limited duplicate sectors from our smallest 5 Best ETF Pairs group. We are limiting the Energy sector to a single pair in this group because their volatility can takeover 3 or more of the 5 positions and result in extreme value changes.

This limit can be overridden by followers who are prepared for higher volatility. It should tend to be more profitable over time, but new followers often start with fewer selections which would be affected more by this decision.

You can always choose your own ‘5 Best’ by reviewing the 20 Best group charts for ETFs or for Stocks. Then check the column heading “Gains Since ………”.

Some Back-Test July Statistics.

Some comparisons between the back testing of ETFs and stocks may be useful.

The average number of days invested in the past year for 26 pairs of ETFs was 304 days or 83% of the year. This is the total of both sides of each pair.

This breaks down to an average of 165 days or 45% of the year for bullish ETFs and an average of 139 days or 38% of the year for bearish ETFs.

Comparing the above ETF total of 83% to stocks, the average number of days invested in the past year for 20 stocks was 255 days or 70% of the year.

Stocks are only invested during bullish trade periods as above or 70% of the year. ETFs are invested in bullish plus bearish directions for a total of 83% of the same year.

The simple answer would be to say that ETFs should therefore make 83%/70% = 119 or 19% more profit than stocks if all else was equal.

There are two opposing facts to make this comparison difficult to know.

First is that a stock represents a single company whereas ETFs, in most cases represent multiple assets. This tends to reduce the overall advantage of the ETFs by averaging the results from their multiple assets.

Second is the 3x leverage of most of our ETF pairs, which tends to increase their overall advantage.

There is a third factor which may further complicate the results. The back tested average length of just the bullish ETF trades during the previous year was 39 days and for bearish ETF trades alone was only 17 days.

The same back test for trading stocks in the bullish direction was 31 days or 26% shorter than bullish ETFs and 82% longer than bearish ETFs.

Concluding these back-test results: -

Bullish ETF trades last for 39 days.

Bearish ETF trades last for 17 days.

Average ETF trades last for 28 days.

Bullish Stock trades last for 31 days.

Note - All the above data applies to the past 12 months of back testing only and does not apply to future trades.

Changes to Groups in July.

There are limited first-day stock signals today and most new stocks are Buys from previous signals. With ETF leveraged pairs, we recommend trading on the first day that a signal changes because they require short-term trades.

With new stock groups, we can expect longer-term trades and more flexibility to make initial buys. Risk-averse buyers should wait for the first day buy signal with a “T”, whereas some investors will buy all stocks with previous buy signals.

New months and groups always sell stocks that no longer belong to groups. Items that are sold are always replaced by higher ranking ETFs or Stocks.

There are times when being in multiple sector pairs such as Energy, is very profitable but the increased short-term risk creates more portfolio volatility.

In the long run, this can make higher profits, but subscribers (if they wish to) can choose this higher risk with duplicate pairs from the “Gains Since” columns on the various group charts or the “20 Best ETF Pairs 3x” chart.

Newcomers to leveraged ETFs will soon get used to making these choices.

Our 10 Best and 20 Best ETF groups will continue to be based on recent profitability and duplicates will not be eliminated. There are 5 various Energy pairs, and these can be eliminated or replaced according to personal preference.

Gold Mining and Volatility pairs will return in July and Semiconductors and Russell 2000 will be dropped from the 20 Best Pairs.

I had a question this week reminding me to mention that all current rankings appear on the “20 Best Pairs” chart in the column “Gain Since March 1st”.

Some subscribers select their own favorites from this list and signals for all 20 of them are provided each evening.

The same Buy or Sell signal applies to all three of our groups and this is the single source for all current month signals for the 20 pairs being offered.

If you wish to keep a record of trade signals each day, you should keep the daily signal Chart 1A for the current month until the end of that month. All previous month trades are added to the Historical Data page when we start each new month.

We are also adding Chart 4XSS to the Blog today for a preview of the current status of our new Stock selections for July, along with the existing ETF Pairs groups.

The stock groups only have 11 days of history, whereas the latest groups of ETFs have 118 days. Annual returns for stocks will be quite volatile until more history is included.

A Few Stocks May Change in July List.

Earlier in June, we showed details of our new 20 Best Stock program that begins on July 1.

It may be necessary to change a few of the stocks that were listed but otherwise the program will remain the same as previously indicated.

We started trading the 20 stocks on June 17 instead of waiting for a complete month of history, but all is working as anticipated.

Many followers have indicated their interest in getting back into stocks and we are pleased to start back again.

We gave a few additional statistics out in the past few days and the summary charts 4X for ETFs and 4XS for stocks will continue to report many of those daily details.

The individual charts on each of the Best group pages are also updated and renewed every evening.

At the end of each month, we upload the latest month of trades onto the Historical Data page, but those current month daily trades will not be updated until the next month end. The only way to get the current month daily trades every evening is to subscribe. Otherwise a complete history of every trade can be found on the Historical Data page.

The new chart 4XSS combines the daily results of the 20 ETF Pairs and the new 20 Stocks program for easy comparison. Looking back over 3 years, ETFs and stocks have both held the best performance position at various times and there is no reason to think the future will be any different.

The main reason for differences is our ability to trade both directions with the inverse ETF pairs, whereas the stocks must move to cash when markets work against them.

30% of Trades Only Last One Day.

To complete some similar analysis to yesterday’s Blog, we looked at our shortest trades.

One unusual trade for DGAZ lasted 116 days as recorded yesterday.

Today we are reporting that 79 of all trades in all 26 pairs during this same period, only lasted for 1 day. We signaled a Buy and then signaled a sell on the very next trading day.

During this period from March 1, we signaled 266 completed round trades with 79 or 30% lasting for only 1 day. The algorithms changed very quickly.

This is all part of the calculations that take part every day for both sides of the 26 suitable pairs that we can follow. Individually, that is 52 ETF decisions every trading day.

For this 116-day period since March 1 until today, that works out to be 266/116 = 2.3 completed trades each day. If 30% of these trades will only last for 1 day, that would be about 70% of all trades that remain for more than 1 day.

It turns out that of those 79 trades, 45 of them made a larger loss than the other 34 made profit. Therefore, the decisions to cut those 79 trades did make a small loss. The amount of loss will vary with the amount each investor had invested but ours was less than $1.00.

Finally, the remaining 187 or 70% of trades that lasted longer than 1 day made a profit. This amount will also vary with each investor.

Investing logic tells you to get out of losers quickly = 30% and stay with your winners = 70%. By this rule, our algorithms are making good decisions over this period since March 1, 2019 until today.

Here are our percentages of actual trades that made a profit for each group. (Reported yesterday on the bottom of Chart 4X and every day).

10 Best ETFs = 6530/2709 = 71%

5 Best ETFs = 3739/1486 = 72%

DGAZ – Completed Very Unusual Trade.

On March 1, 2019 along with all other current groups, we purchased DGAZ for $88.14 at the open.

The average trade in these leveraged Exchange Traded Funds would be held for less than 10 days.

This unusual trade was held for 116 days and made a profit of about 95% at an annual rate of 300%.

This profit follows a loss of 12% just in the last 2 days alone.

Leveraged ETFs are not normally bought for long-term trades due to their high daily management costs.

So why did our algorithms hold this ETF for 116 days and make this large profit?

The main reason for holding on to this position seems to be the accelerating decrease in the market value of natural gas over this same period. There were reversals in market value but not enough to affect the algorithm until yesterday, June 24 when we advised selling it today, June 25 at the open.

DGAZ is the inverse side of this natural gas pair and made strong profits as the value of the underlying gas declined.

The more appropriate story behind this profit are the number of decisions to stay in DGAZ. Every market day during this 116-day trade, the algorithm made a new and revised decision to hold on for one more day.

Here are the percentages of profitable trades for each group as seen on the bottom of Chart 4X every day.

10 Best ETFs = 71%

5 Best ETFs = 76%

Despite Indiscriminate Volatility.

Exchange Traded Funds and Stocks trade inside of trends that can be short-term or long-term.

These various trends make up financial climates that each individual asset must react to and evaluate for themselves.

There are climates that last for years and there are known pre-specified dates such as single-day holidays.

The VIX Volatility Index follows some of these trends, but also reacts to the 6:00 o’clock news and today’s 24-hour news.

This can sometimes help and sometimes hurt but can’t be planned or expected.

This indiscriminate volatility cannot be part of our algorithms, especially as our signaled trades are for the next available trading day.

However, over various periods, it likely helps and hurts about equally, 50% of the time in each direction. If not equally, then for the past 3 or more years, we have overcome its effect on profits.

One of the known impacts of volatility, is it generally goes up fast and comes back down slower. For this reason, trends in volatility can be more profitable with declining volatility because they are more predictable and longer.

Inverse ETFs very much depend on volatility occurring when you are in the side of the pair that benefits from it. Leveraged ETFs can be painful when in the wrong side.

Stocks are dependent on volatility in all sorts of ways, depending on which stock you happen to be holding, but can be mostly hurt by rising indiscriminate volatility.

A final observation is that sudden rises in volatility are largely followed by sudden but smaller declines.

This requires judgement, as they could last for a day, a week or a month. Our algorithms can deal with those that are consistent and longer than a few days; often quite well.

Stocks Program for July – Part 3.

The 20 stocks chosen for the starting month in July will all remain as the Best 20 group.

However, the Best 10 and Best 5 stocks will be selected from those 20 stocks, based on profits from the starting date of June 17 through Friday June 28.

You may remember that we normally like to have a full month of profits when starting a new selection, but we are bringing the starting date forward to July 1 rather than waiting until August.

We are pleased with the new selection process and want to begin ASAP.

We are also pleased with the recent method applied to our ETF group selections and will use it on the new Stock groups as well.

The 26 suitable inverse pairs of ETFs currently available to us may slowly expand with the large increase in popularity of these inverse pairs. We will watch for new pairs to add.

It works out nicely that each month we drop the worst 6 pairs and offer the Best 20, Best 10 and Best 5, but this may not suit all investors.

I would not be surprised, if you chose to drop another 5 to create the Best 15, Best 10 and Best 5. Future trends and performance affect all selections and current world news events and associated volatility make timing the most difficult factor.

We see the approximate dividing line between profits and losses (in a 30 day period), is close to the 20 out of 26 Pairs line. This means choosing the Best 15 Pairs should be a better choice than the Best 20. We will leave that suggestion up to each Subscriber.

As a rule, for the future, when we find suitable pairs to add to our current base of 26 Pairs, the best and most conservative portfolio could be in the range of the Best 70% of available pairs. This would place a good conservative risk profile at about 18 out of the 26 pairs today. We are considering using this percentage concept sometime in the future.

Recall that trading both directions using inverse pairs together with our algorithms, reduces portfolio risk substantially. This remains true with leveraged pairs also.

Travelling Today – See New Stock Chart.

Sample of early stock results added to 4X chart. (Now $XSS Chart) Looking good for 4 days trading?

Stocks Soon Back – Part 2.

If everything works out as planned, stocks will be back on July 1.

We expect to follow the same pattern as the ETF groups and select the 20 Best Stocks. The “10 Best” and “5 Best” will be selected from the 20 Best.

We initially expected to start trading these stocks on July 1 and then begin publishing on August 1, but we were able to start trading on June 17.

This means that stocks will only have 10 trading days of history on July 1 when we normally rollover to the new month; less than we would like but worth doing.

The algorithms are fully back tested for 3 years with the same methods that we use for ETFs. By the end of this week, we will have the presentations for the website, Subscribers and Followers completed.

There has been a great deal of interest in stocks, but our main concern was to develop a better way of selecting which stocks to include.

We now expect to have a continuous ranking system so that each day you will see the complete monthly list of 20 stocks each evening with a column showing “Gain Since 17-Jun”. The 10 Best and 5 Best will be part of this group but also have their own columns.

You can see that these individual stock groups will be presented in the same way that the ETF groups are now shown. Subscribers will see a combination of two independent charts, one for ETF Signals and one for Stock Signals.

ETFs Pairs will always retain one ETF algorithm for trading up and the opposing algorithm for trading down, giving them this unique ability to profit in both directions.

Stock algorithms can only profit from trading up and move to cash in down markets.

Past results have shown that stocks can perform equally as well as ETFs, probably due more to the different trending characteristics, but also due to the selections available.

We have improved our selection process for stocks but may have fewer ‘high flyers’ that have disappointed us in the past.

Stocks Soon Back in Our Program.

We have been testing better ways to include stocks in our program.

Followers will recall that we started with stocks 3 years ago and quickly found the advantages of Exchange Traded Funds and Notes.

There have been a couple of problems with stocks relative to ETFs in the past.

The first is making an appropriate selection of stocks that are a good investment on their own merit, without relying on our algorithms.

The other main consideration is we can only trade them in a single direction.

We have now improved our systems to include a much-improved method of selecting stocks along with improved algorithmic performance.

The stocks currently show better than a 230% average improvement when using our algorithms. They also share the same speedy in and out short-term trades that help their risk profile by staying out of downtrends.

They are often more sensitive to trends because they represent a single corporation whereas most of our ETFs represent indexes or sectors with multiple assets.

They will be out of the market during downtrends but will benefit from the longer trends that more often occur with single stocks.

The rapid recognition of direction by our algorithms will remain a key ingredient as it does with ETFs.

When considering the past few years of performance, stocks have performed almost equal on average to ETFs but often on a different time-cycle. This may provide opportunities for mixed portfolios, depending on your preference.

Stocks have an advantage of public awareness whereas ETFs are relatively unknown to many individual investors.

Professional portfolios are trading very large volumes of ETFs because of their subject variety and the much lower costs compared to mutual funds. Trading in both directions together with various degrees of leverage offer greater usefulness to portfolio managers.

eSignal Data Feed Corrections.

eSignal data feeds for Microsoft Excel spreadsheets comes through a program called QLink.

A while ago, there was a problem in getting opening prices during the balance of the opening day and some of them were incorrect.